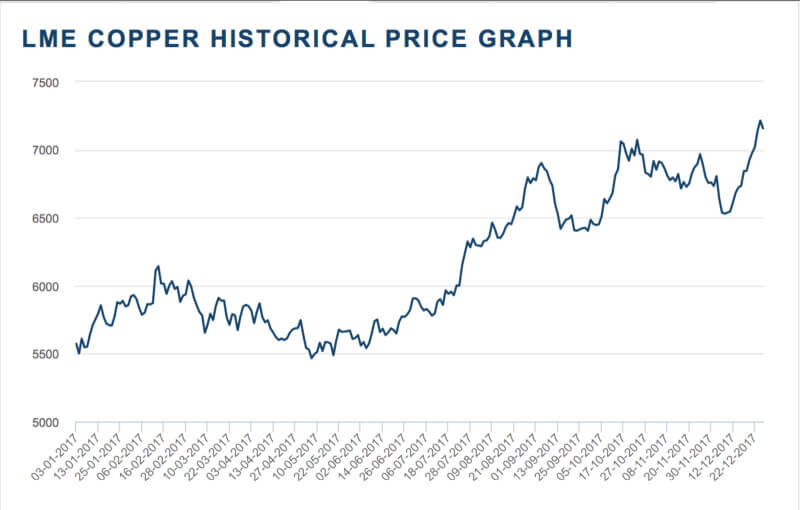

Recently, the Federal Reserve has adopted substantial interest rate hikes to ease the pressure caused by high inflation, and central banks in Switzerland, the United Kingdom, and some Middle Eastern countries have followed suit and joined this wave of interest rate hikes. Although the interest rate hike shows the determination of overseas countries to ease inflation, the aggressive interest rate hike has also triggered worries about the global economic downturn, resulting in poor market confidence in future demand, and the prices of non-ferrous metals are generally under pressure.

In early June, the World Bank lowered its global growth forecast for 2022 again in its Global Economic Outlook report, to 2.9%, well below the 4.1% expected in January 2022. The World Bank said that the new crown epidemic has seriously affected the global economy, and the conflict between Russia and Ukraine has made the global economy even worse, and many countries are facing the risk of economic recession. It is reported that in April, the World Bank lowered its forecast for global economic growth in 2022 once, from 4.1% in January to 3.2%.

At present, the inflation pressure in Europe and the United States and other countries is still huge, the US economic data is weak, the European energy crisis intensifies, and the risk of inflation and economic recession has put the market under obvious pressure. Tesla CEO Elon Musk said that the U.S. economy may experience a recession by the end of 2023, and more and more financial institutions and investors are warning that the possibility of a U.S. recession is increasing. On June 20, Goldman Sachs released a report saying that in 2023, the U.S. economy will have a 30% chance of falling into a recession, higher than the previous forecast of 15%; the cumulative probability of a U.S. economic recession in the next two years is 48%, higher than previously estimated. 35%.

Domestically, the expectation of stable economic growth is relatively strong, but domestic local epidemics are repeated, overseas liquidity is tightened, and the economic downturn is expected to heat up. The prices of metals such as copper and aluminum will remain under pressure in the short term. In addition, as the U.S. economy fell into stagflation and dollar liquidity contracted, some commodities showed signs of peaking, and funds were withdrawn and bubbles were squeezed out.

In the later period, overseas interest rate hikes will still affect the macro environment, especially the further accelerated pace of monetary tightening by the Federal Reserve, and the strong dollar may continue to put pressure on copper prices.